Framework for risk allocation in project finance | "Giga-projects" to help double size of Riyadh | AV terminal shuttle debuts at EWR

infrastruttura

no. 34

As China's and the West's dueling plans for global infrastructure investment crystallize in the coming months it's likely both will include significant project finance components.

Having a framework to think about how risks are shared between project stakeholders in that context will therefore become increasingly important as capital is deployed globally on mega-projects (and "giga-projects" - more on them below).

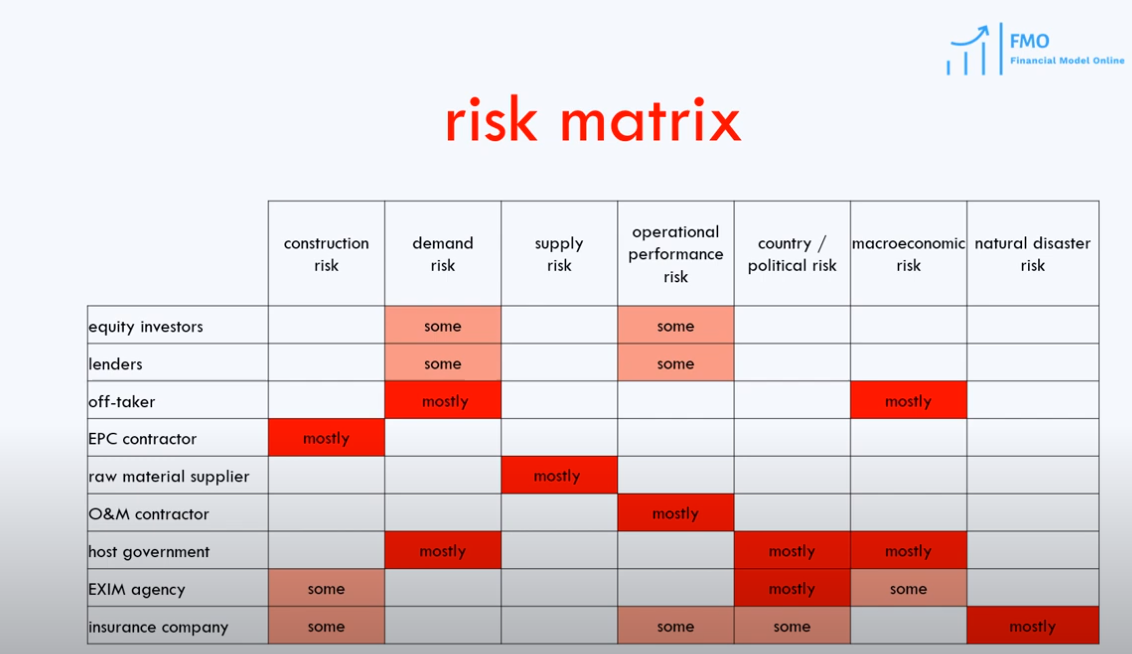

A neat video that I saw on LinkedIn does exactly this, explaining concisely how each risk plays out across the entire infrastructure project life cycle. Most importantly, it outlines which parties should generally retain each risk (though of course the particulars will vary based on the project's scope, market sector, and location).

Here's a quick summary of how that exercise should end up: each risk is allocated to the party in the best position to manage it. Of course, this allocation is always much easier said than done (as you can see below where some risks must be shared between stakeholders. Credit to Financial Model Online.)

The risks listed across the top of the matrix can be organized more generally into four main categories:

- Project-specific risks: these are the risks associated with project development (with a time horizon of 3-10 years needed in order to acquire land and permits, depending on the geography and scope), construction (1 to 5 years, also depending on the geography, scope, and project complexity), operations, and decommissioning.

- Macroeconomic risks: exchange rates, inflation.

- Political risks: changes in government leadership, priorities, geopolitics.

- Natural disasters

Project-specific risks in particular can be broken down further into pre-completion risks and post-completion risks.

Pre-completion risks

These risks can be very expensive to mitigate because they are highly speculative, even during the project development stage. They include the time-consuming tasks of executing technical studies, land acquisition, and permitting. At this point the sponsors (who set up the project company that will finance and develop the project) will in most cases be uncertain if they can even secure funding. So these risks will sit entirely with the sponsors. Their expertise developing (or walking away from) similar projects is really their only available risk mitigation tool.

It's also worth noting here that project finance is highly structured. Any issues that arise at each step in the project development chain can have knock-on impacts for those that follow, amplifying any subsequent liabilities for the project sponsors and their lenders. This is most critical during the construction stage, where there are three major pre-completion risks: delay, completion, and performance.

First, delay risk. Will the project get built on time and on budget? If not, the lenders will not get paid back as required. Buyers, or users, will not receive or get the benefit of the project's output. And suppliers will be unable to sell into the project (like the supplier of raw materials to an industrial processing plant).

This risk is contained within the project's EPC contract through a liquidated damages regime that should compensate the project company for each day of delay in an amount equal to the corresponding costs that it will incur (including financing and lost opportunity costs).

The second, related risk is completion risk. Will the project get built at all? The EPC contract will include a completion guarantee that is backstopped through a security package that can run the usual gamut of performance bonds, parent company guarantees, letters of credit, and/or other security depending on the location of the project and lender requirements. Finally, the EPC contractor will also take on the risk that when completed the project will actually perform as required (i.e. it must generate the expected levels of output).

Post-completion risks

Once a project is completed the risks become operational. First, there is revenue risk. Will a market exist for the asset's output at the projected price (i.e. power, traffic demand, etc.)? This risk can be mitigated through "take-or-pay" arrangements: commercial contracts where buyers agree to pay for a specific quantity of output at a specific price. This generates predictable cash flow for the project company and usually requires only a small number of buyers to set up.

On the other hand, if there are many "buyers" (or users) of an asset like a toll road or power plant, sponsors can mitigate their risk through government support (essentially subsidies that cover project fixed costs and debt service if revenues fall short). But this mitigation measure would only exist if the project is developed through a concession or P3, or if the government establishes an availability payment compensation model (these are fixed payments to the sponsors independent of any revenue the asset might generate, provided it remains in operation according to some minimum performance criteria set by the government).

Supply risks are the converse. They are mitigated through "put-or-pay" arrangements, where suppliers will agree to provide raw material to the project at a fixed price during a negotiated, fixed period of time. (Or they must provide the material from another source.) Finally, operational risks (that the project will perform as required and equipment will remain in a state of good repair) are assumed by the O&M contractor and allocated according to terms in the O&M contract.

Risks common to both pre-completion and post-completion phases

Some risks are by nature common to both phases. In general the project sponsors can shift macroeconomic risks to third parties. For example, inflation risks can be passed through contractually via a price escalation clause to the project off-taker (i.e. the buyer of the asset's output). Exchange rate risks (if the project is developed with hard currency but revenues are generated in the local currency) can be shifted to the host government through a compensation scheme in the project development agreement, or the sponsors can hedge them through other financial arrangements. Political and natural disaster risks can similarly be shifted in most cases to the host government or insurers.

There is obviously much more detail that goes into preparing a risk matrix for a cross-border project finance transaction involving complex civil infrastructure. But this outline is a good framework for thinking about how to shift each category of risk on these types of projects. (Financial Model Online)

Saudi Arabia plans to double the size of Riyadh with over $1T in planned construction, hoping to transform its desert capital into a global city.

The West is trying to improve both connectivity and relations with its partners in the Middle East. But local infrastructure investment is also continuing at a frenetic pace as oil-rich governments try to position themselves for a hotter but hopefully cleaner future by diversifying their economies.

In Saudi Arabia, by the time the capital Riyadh hosts Expo 2030, its population could double from 7.5M to 15M thanks to nearly 700,000 new housing units either planned or already under construction. Thirty ongoing mega-projects in the transit and aviation sectors, coupled with a nearly $8B master plan for the Expo and loosened visa rules for tourists will also help turn Riyadh into what the Saudis believe can be a top-10 global city. But the city is already well on its way; today the capital generates nearly 50% of the Kingdom's non-oil economic activity.

Currently Riyadh has over $12B in projects under construction, including the $20B+ Riyadh Metro and a new Foster + Partners-designed, 6-runway international airport. Another $18B is at the evaluation and/or proposal stage and $170B is in the pipeline. All of this is part of Saudi Arabia's Vision 2030, which aims to modernize and diversify the Kingdom's economy away from fossil fuels, all driven by the country's deep-pocketed Public Investment Fund.

The master plan for Riyadh's Expo calls for a museum, a technology and design university, and more than 80 cultural and entertainment venues across 19 square kilometers on the northwest side of the city. For the 2030 event, Riyadh was selected over Italy's Rome, South Korea's Busan and Ukraine's Odesa; it is only the second Arab country to host an expo after Dubai, in the UAE, in 2020. (These expos are essentially a continuation of the world's fairs held in the US during the 20th century, and are held under the organizing auspices of the Paris-based Bureau International des Expositions international sanctioning body.)

Construction projects in Saudi Arabia are getting so big that they are not even called mega-projects anymore: instead they have been dubbed "giga-projects." These include NEOM (with $70B in contracts awarded, 45 percent of which are already complete), the Red Sea Project (a 30,000-square-kilometer coastal resort), and Qiddiya (an amusement park and resort destination southwest of Riyadh). (Construction Week)

Newark Liberty is the (not entirely) undeserving butt of airport jokes and, once again, finds itself at the bottom of a recent list of "mega-airport" passenger rankings.

But things should improve for EWR next time around for a few reasons: its sparkling new $2.7B Terminal A is getting rave reviews, while the Port Authority is also advancing plans for a P3 to replace the gloomy and outdated international Terminal B. (If you're keeping score, Seattle-Tacoma, Pearson in Toronto, and EWR were ranked at the bottom of this "mega-airport" list compiled from passenger feedback; Detroit, Minneapolis, and Las Vegas came out on top.)

EWR should get credit for some recent forward-thinking, too: it has launched an autonomous parking shuttle pilot project to test AV technology which the Port Authority ultimately hopes to deploy across its regional transportation assets, from EWR, LGA, and JFK to express bus lanes through the Lincoln Tunnel.

This particular AV shuttle is now running between EWR's new Terminal A and the P2 parking garage (which is connected to the AirTrain link between the airport and the New Jersey Transit/Amtrak EWR station along the Northeast Corridor). It is the first time an AV is operating on a public road anywhere in the state of New Jersey.

STV and Perrone Robotics are leading the month-long pilot project, which responded to a Port Authority RFP for "solutions to last-mile transit challenges for short-length transportation options." The team retrofitted a 14-passenger, all-electric GreenPower AV Star shuttle bus with AV technology for the pilot, incorporating road sensors, cameras, and mapping ability. It tested the shuttle on a safety course and then airport roads at night before launching.

EWR isn't the first American airport to test AV technology; Phoenix, Las Vegas, and DFW have all launched similar pilots. But earlier this year at JFK the Port Authority did test the first three-vehicle AV platoon together with Ohmio, a New Zealand-based autonomous mobility company, using eight-passenger AV shuttles traveling around 7 feet apart at 20MPH without any physical connections.

Airports are a good test environment for AVs for a few reasons. They are controlled, structured spaces (with well-maintained roads, clear signage, and reliable traffic patterns, compared to the chaos and complexity of city streets and highways). Airports also run on tight but consistent schedules, offering benchmarking opportunities to demonstrate how AV operations can improve efficiency. And they can also expose diverse audiences to new technologies, generating interest and support for transportation alternatives in other use cases.

The Port Authority continues to have ambitious expansion plans for all of its New York/New Jersey region infrastructure assets, driven in part by the looming 2026 World Cup and decades of underinvestment. AV technology has the potential to make connections within and between facilities easier, faster, and more reliable for those crowds (which in EWR's case should also help its rankings on the next passenger survey). (Transportation News Today, Business Insider)

Member discussion